Do Home Insurance Claim Adjusters Lowball ?

History has shown that insurance companies are often in an adversarial relationship with their policyholders. Insurance lawyers help even the odds.

“Businesses and homeowners will be filing hundreds of thousands of home insurance claims for property damage due to the arctic storm that hit Texas and the rest of the country in mid-February 2021,” stated Plano home insurance attorney Nejat Ahmed. “The storm crippled the Texas electrical grid causing water pipes to freeze and burst in homes across the state. Businesses also suffered massive losses starting with the energy companies and those that actually produce and deliver natural gas, oil, gasoline, and other fuels. Most of the state’s economy was crippled for a week.” In addition, restaurants and grocery stores had to throw tens of thousands of tons of food into the trash because freezers and refrigeration equipment had no power for too many hours.

What Are Some Insurance Tips After The Storm?

– Contact your insurance company as soon as possible to begin the claims process

– Do NOT discard damaged property, furniture, cars, etc. without approval from the insurance company

– Document EVERYTHING – photos, videos, detailed list of damaged items, and detailed notes of every conversation with insurance representatives

There is no doubt that insurance companies will have to pay many billions to the businesses and homeowners that purchased home insurance and property damage policies. It is estimated that more than 4 million Texas homes were without power during this arctic storm. Some residents had only one day without power but the majority had two to four days without power. The many thousands of property damage claims will probably take more than a year to process.

In addition to homeowner property damage claims, scores of attorneys will be defending energy providers and other entities from personal injury and wrongful death lawsuits. Preliminary data from the state health department indicates that at least 57 people died as a result of the winter storm, including an eleven-year-old boy who froze to death in Houston. Lawsuits are also being filed claiming financial loss, business interruption, and excessive electric charges.

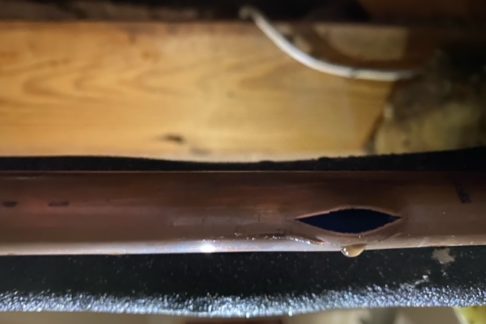

In the state of Texas, most homebuilders route incoming water lines in the attic and then drop them down walls to service kitchens and bathrooms. Problems occur when the temperature in the attic is 32 degrees or lower. The water first freezes and then expands and cracks the metal or PVC pipes. Incoming water lines are under pressure and when the temperature rises and the ice begins to thaw, the cracked water lines will spray the attic, roof decking, ceilings, and floors with hundreds to thousands of gallons of water unless the homeowner promptly shuts off the water to the home. If the homeowner is not present then the home will literally be flooded from within.

Among the fifty U.S. states, Texas is the second largest property insurance market. State Farm is considered the largest homeowners’ insurer in Texas and in 2020, they processed approximately 75 claims for cracked and broken pipes due to cold weather. They will be processing thousands of homeowner insurance claims for frozen pipe damage in 2021.

Given the historical volume of damage claims and the hours required to process them, the insurance companies are under tremendous pressure to minimize the payouts to claimants (also known as lowball). Those who are not satisfied with their offer from an insurance company, or have had their claim denied, should consider obtaining legal advice from an experienced attorney with homeowner insurance claims.

LeMaster & Ahmed PLLC, Texas Insurance Lawyers

LeMaster & Ahmed PLLC are Texas Insurance Lawyers and represent policyholders to ensure they receive the insurance benefits they are owed. Experienced insurance claims attorneys can help to protect policyholders from denied claims, underpaid claims, delayed claims, and bad faith from adjusters and insurance companies.